No products in the cart.

How we get started?

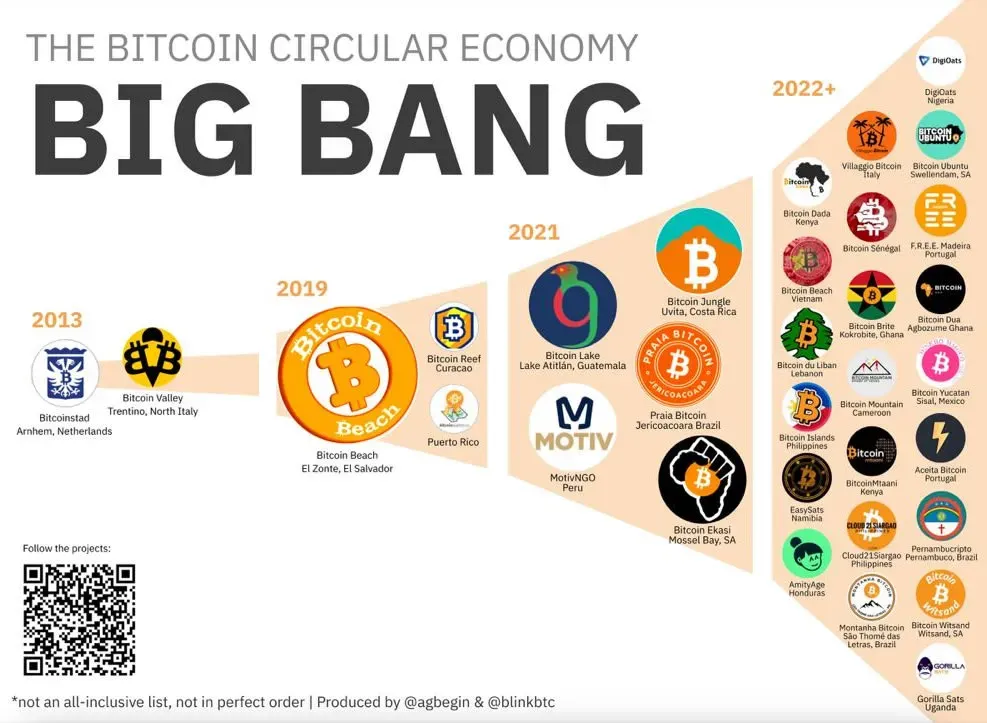

After the publication of the Bitcoin Beach White Paper, several communities embracing Bitcoin emerged worldwide, looking for efficient solutions to use Bitcoin as a tool for social transformation and financial inclusion.

Why?

Fernando Motolese, the visionary founder behind Brazil’s Bitcoin Beach, embarked on a profound exploration of the circular economy concept, culminating in the creation of the innovative Bitcoinize Machine.

This remarkable device was designed to offer fresh fruits at the cost of just 10 sats while simultaneously integrating local merchants into the digital economy.

Subsequently, the Bitcoinize Machine prototypes commenced their transformative journey across various communities, captivating the interest of Bitcoin enthusiasts worldwide.

In a remarkable development, the Bitcoinize crowdfunding campaign was launched in July 2023. Within a mere three months, it achieved unprecedented success, becoming the most generously funded project on Geyser, amassing a total of 3.5 BTC to fuel the product’s development.

How the Bitcoinize Machine works?

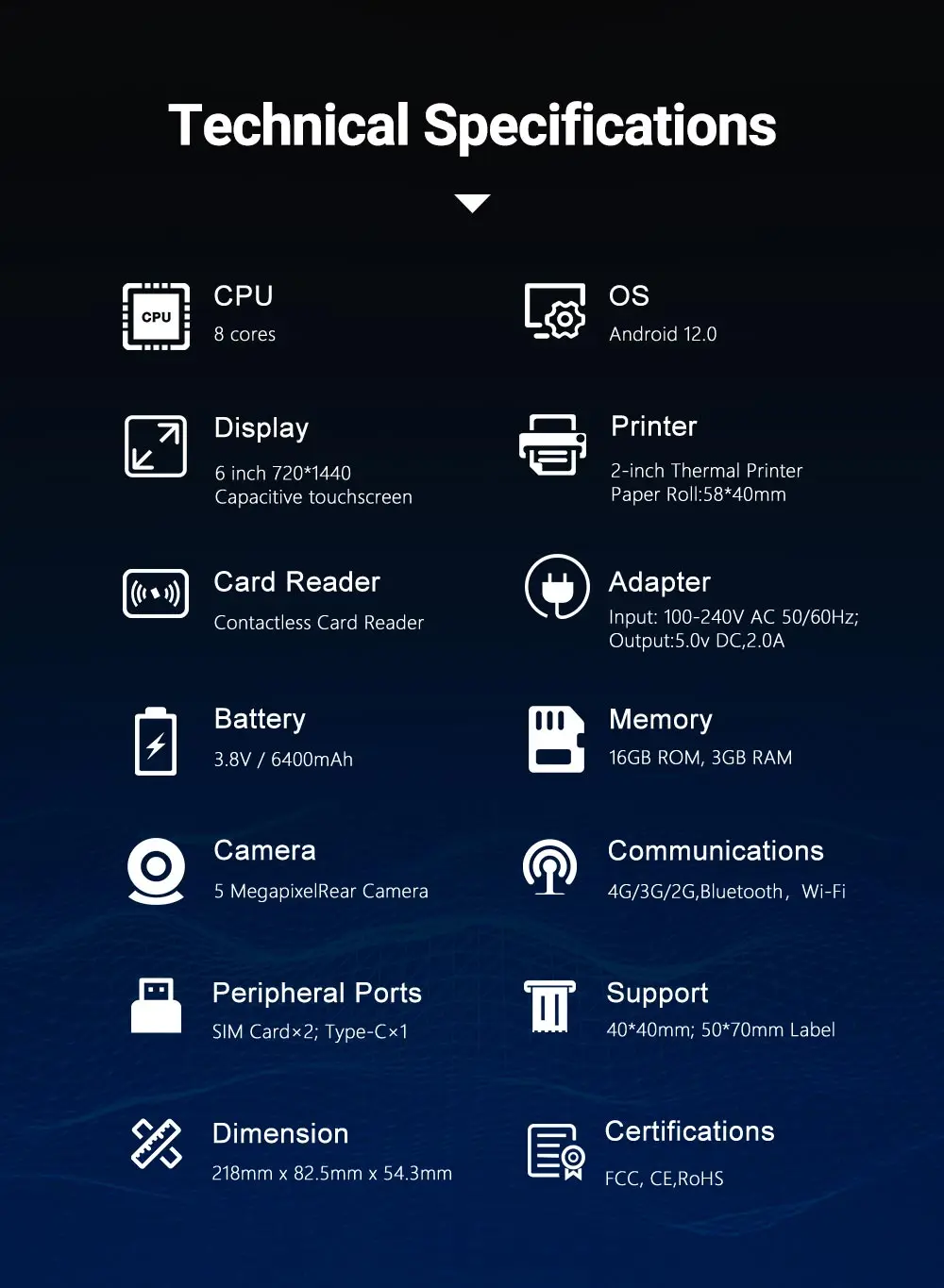

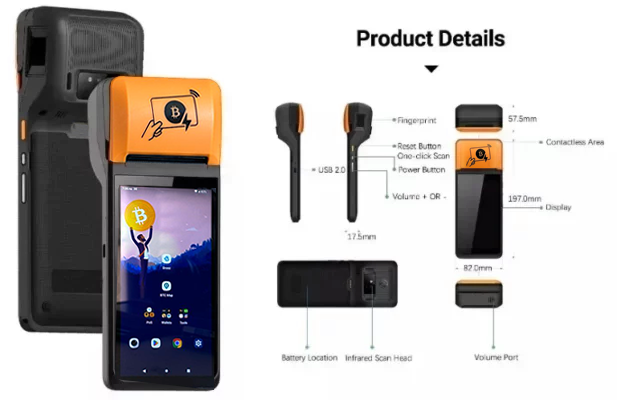

The Bitcoinize Machine is a Android 12 tablet with a thermal printer and NFC capabilities, optimized for Bitcoin and Lightning Payments with pre-installed apps.

How to receive Bitcoin Payments?

You can choose noncustodial solutions like BtcPayServer, Breez, Zeus LN, BlueWallet, Bolt Card Wallet, LNBits or custodial solutions such as Blink Wallet, SwissBitcoin Pay and Wallet of Satoshi.

Approved by Thousands of Users

The Bitcoinize Machine isa symbol of the peaceful revolution, carrying a message, that any smartphone can use bitcoin as a tool, but it is better to have a dedicated device to enable bitcoin as a means of exchange.

Ready to Bitcoinize the World ⚡

Through a partnership with a Chinese Manufacturer, we can produce 21,000 machines per month to accelerate the hyperbitcoinization process.

Tested WITH

Technical Specifications

Hardware Details

Other Features

Ready for Contacless Payments

Thanks to the Bolt Card open-source technology, based on NXP NTAG424 DNA chips and LNURL protocol, users without smartphones can make contactless payments in Bitcoin with instant settlement.

Google Play Unlocked

Users can follow the evolution of the market by updating the pre-installed apps using Google Play Store or install any app they want, with no restrictions.

Use for everything

Music player, mobile cashier, receipt printing, pin storage, queuing, billing, label printing, QR code collection and NFC membership management

Financial Inclusion & Freedom

Empowering Financial Inclusion with Bitcoin Circular Economies. Now, more than 1000 kids without smartphones in various remote regions and more than 150 businesses are using bitcoin as a medium of exchange, thanks to the Bitcoinize Machine.

QR Code Scanning

Receipt and Label Printing

Two 4G SIM CARD SLOTS

Customers are lovin’ it

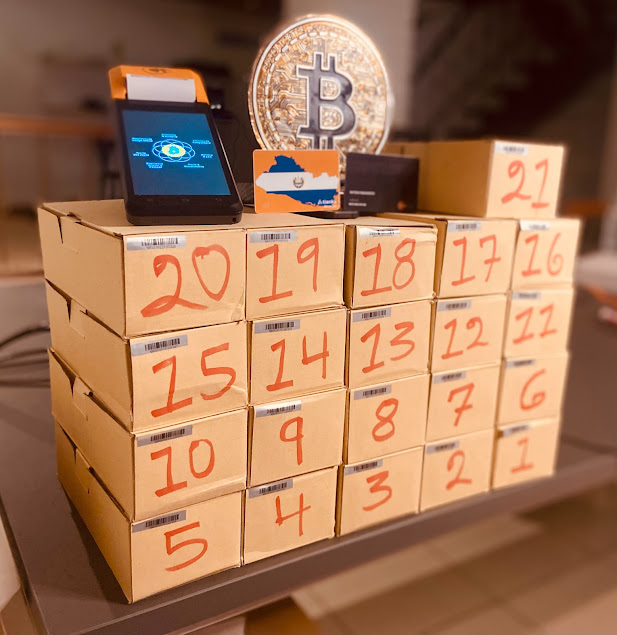

How BTCPay enabled 20 merchants at a conference to accept Bitcoin?

Get in touch

Bitcoinize.comAbout the store

Bitcoinize.com LTD is a registred company in Ras Al Khaimah – United Arab Emirates

Address

RAK DAO business Centre

Sheikh Mohammed Bin Zayed,

Office A – GF, PV58+5J2

Ras Al-Khaimah – UAE

Contacts

[email protected]

+44 (20) 8180-8267

+971 (58) 550-4338

Telegram: @BitcoinizePOS